7 Factors that Influence Your Bad Credit Car Loan | 2024

So, your credit score isn’t exactly sunshine and rainbows, but life still throws curveballs like needing a new set of wheels. Fear not, fellow road warriors, for bad credit doesn’t have to derail your car-buying dreams. Take a moment to understand how bad credit car loans can be affected by hidden potholes before you hit the accelerator.

In the pursuit of a dream car, navigating the labyrinth of bad credit can be challenging. You will be able to unlock the road to vehicular freedom by understanding the factors that influence your bad credit car loan. Let’s explore the seven critical factors that can shape your journey and empower you to make informed decisions.

Missed or Late Payments: The Weight on Your Credit Score

Your credit score is a numerical representation of your creditworthiness and missed or late payments can significantly impact it. To determine if you can meet your financial obligations, lenders closely examine your payment history.

Each missed or late payment screams “risk!” louder than a car horn stuck on high. Expect higher interest rates, stricter terms, or even a flat-out loan denial. In the case of persistent lateness or default, more interest rates may be charged or the loan may be rejected outright.

Closing a Credit Account: The Domino Effect

Closing a credit account might seem like a prudent move, but it can trigger a domino effect on your credit score. It affects your credit utilization ratio, a crucial factor in credit scoring models. Suddenly closing a bank account can negatively affect your creditworthiness, which, in turn, impacts the terms of your car loan.

While you might think cutting ties with a maxed-out credit card is a heroic act, lenders see it as a red flag. Depending on how much credit you’re using compared to your total credit limit, closing an account can affect your credit utilization ratio. A high ratio signals potential overspending, making lenders nervous.

Income: The Fuel for Your Loan Approval Engine

Buckle up for some good news! Your income plays a starring role in loan approval. A steady, healthy income reassures lenders you can handle the loan. So, that promotion you just landed? Mention it. Every bit helps!

Lenders evaluate your income to gauge your capacity to repay the loan. A bad credit car loan becomes more difficult to get if your income is consistent and sufficient. Having a stable income is essential for convincing lenders you can pay back a car loan.

Exceeding Your Downpayment Limit: Balancing Act

While a larger down payment can enhance your chances of loan approval, exceeding your financial limits can lead to other complications. Striking the right balance is crucial. A substantial down payment can reduce the loan amount and, consequently, the monthly payments, making the loan more manageable for you and attractive to lenders.

Remember that tempting feeling to skip the down payment and drive away with your new car today? Resist it! A sizable down payment shows lenders you’re serious about commitment and reduces the loan amount, making them more inclined to lend.

Opening Multiple Accounts: The Perception of Instability

Frequent credit inquiries and opening multiple accounts quickly can create the perception of financial instability. Each credit inquiry can slightly impact your credit score. Lenders may view multiple recent inquiries as a sign of desperation, affecting your ability to secure favorable loan terms.

Applying for several loans or credit cards in a short span can trigger loan sharks’ alarms. Lenders see this as financial desperation, making them question your ability to manage debt. So, hold your horses before applying for that new furniture loan!

Past Account Settlements: Lingering Shadows

Past account settlements, especially those marked as “settled” or “paid as agreed,” can cast lingering shadows on your credit history. While settling an account is a responsible step, lenders may view it as a sign of financial distress, potentially impacting your loan approval and terms.

While settling past debts might feel like a victory, it still leaves a mark on your credit report. Be prepared for lenders to factor in these settlements when determining your loan terms.

The Dealer’s Profit: Understanding the Game

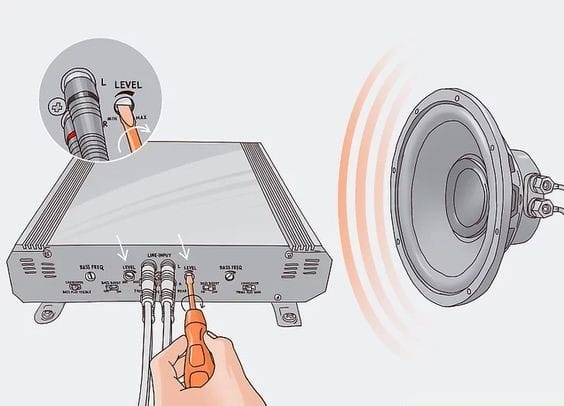

Car dealerships may offer financing options, but be wary of the dealer’s profit margin. Sometimes, the convenience of in-house financing comes at a cost – higher interest rates or unfavorable terms. Shopping around for external financing options can empower you to negotiate more effectively and secure better terms.

Don’t underestimate the dealer’s role in shaping your loan. Some dealerships partner with lenders who specialize in bad credit loans, but these often come with hefty interest rates. Do your research, compare quotes, and negotiate to avoid getting saddled with an unfair deal.

Final Thoughts: Navigating the Bad Credit Car Loan Terrain

Securing a bad credit car loan is not an insurmountable challenge. By understanding and addressing these seven factors, you can confidently navigate the terrain. Consistent financial responsibility, strategic planning, and informed decision-making are the keys to unlocking the road to your dream car, even with a less-than-perfect credit history.

Getting a bad credit car loan is like navigating a back road – bumpy, and unpredictable, but with the potential to lead you to your destination. By understanding these key factors and being a responsible borrower, you can smooth out the ride and land a loan that gets you cruising toward car ownership bliss. Remember, knowledge is power – use it to fuel your journey!

So, buckle up, fellow bad credit warriors. With a little caution and these insights in your toolbox, you can navigate the bumpy road to car ownership and leave those financial potholes in the dust!

FAQs:

How do get a bad credit car loan?

Obtaining a bad credit car loan may be challenging, but it’s not impossible. Here are some tips to improve your chances and navigate the road to car ownership:

- Check Your Credit Report

- Assess Your Finances

- Set a Realistic Budget

- Save for a Down Payment

- Research Lenders Specializing in Bad Credit

- Prequalify for a Loan

- Explore Dealership Financing

- Consider a Co-Signer

- Look for Subprime Lenders

- Negotiate Terms

- Read and Understand the Terms

- Make Timely Payments

How much does a car loan affect your credit score?

A car loan can have both positive and negative effects on your credit score, depending on how you manage it.

Remember: Your credit score is dynamic and constantly changing. By practicing responsible credit management, including making on-time payments and keeping your credit utilization ratio low, you can mitigate any negative impacts and potentially benefit from your car loan in the long run. Here are several ways in which a car loan can impact your credit score:

- Credit Inquiry

- New Credit Account

- Credit Mix

- Payment History

- Credit Utilization

- Loan Payoff

Can I refinance my car with a 500 credit score?

It is possible to refinance your car loan with a 500 credit score, but it will likely be more challenging and come with certain limitations compared to someone with a higher score. Here’s a breakdown to help you understand your options:

Challenges:

- Higher interest rates

- Fewer lenders

- Stricter terms

Potential benefits

- Lowering your interest rate

- Consolidating debt

- Improving your credit

Before you attempt to refinance

- Check your credit report

- Gather your financial documents

- Shop around

- Consider a co-signer

Remember: Refinancing with a 500 credit score requires careful planning and research. Weigh the potential benefits against the limitations and costs involved before making a decision. Consider consulting with a financial advisor or credit counselor for personalized guidance.

Are car loans good for credit?

Whether car loans are “good” for your credit depends entirely on how you manage them. It’s a double-edged sword with both potential benefits and drawbacks. Here are some ways in which car loans can impact your credit:

Positive Impacts(pros):

- Increase Credit Mix

- Payment History

- Longer Credit History

- Building Positive Credit

Negative Impacts(Cons):

- Credit Inquiries

- Debt Load

- Late Payments of Defaults

- Repossession

To maximize the positive impact

- Shop around for the best possible interest rate and terms.

- Make your monthly payments on time, every time.

- Keep your credit utilization ratio low.

- Consider a shorter loan term if feasible.

Remember: Your credit score is dynamic and constantly changing. Responsible credit management through consistent payments and a healthy credit mix can help you benefit from a car loan in the long run.

Who gives bad credit car loans?

There are several options available for people with bad credit seeking car loans, each with its own advantages and disadvantages. Here are some common types of lenders who may be willing to work with individuals with bad credit:

Traditional Lenders:

- Banks and credit unions

- Online lenders

Subprime Lenders:

- Specialty car dealerships

- Finance companies

Alternative options:

- Credit union loans with co-signer

- Pawnshop title loans

Things to consider:

- Interest rates

- Terms and fees

- Down payment

- Your budget